一、cme机床是什么意思?

您好,CME机床是指由CME公司生产的机床。CME是一家总部位于西班牙的机床制造公司,专门设计和生产高精度数控机床。CME机床通常用于金属加工领域,包括铣床、车床、钻床等。这些机床以其高精度、高效率和稳定性而闻名。

二、亚洲最大的机床展 - CME机床展

什么是CME机床展?

CME机床展是亚洲最大的机床展览会之一,每年吸引来自世界各地的机床制造商、经销商、采购商以及机械工程师等专业人士参与。该展会旨在展示最新的机床技术和创新,推动机床行业的发展和合作。

为什么参加CME机床展?

CME机床展提供了一个绝佳的平台,使参展商和参观者能够了解最新的机床技术,探索合作机会,并拓展业务网络。以下是参加CME机床展的几个主要原因:

- 了解最新技术:参展商将展示他们最新的机床技术和创新,使参观者能够了解行业的最新动向,把握机械制造的未来方向。

- 建立业务联系:CME机床展是一个与机床制造商、经销商以及采购商进行交流和合作的绝佳平台。参展商和参观者可以建立业务联系,并探索新的合作机会。

- 拓展市场:参展商有机会向全球来自各行各业的专业观众展示他们的机床产品和服务,帮助他们在市场上树立品牌形象,吸引更多潜在客户。

- 专业论坛和研讨会:CME机床展还将举办一系列的专业论坛和研讨会,探讨机床行业的最新趋势、技术和应用。参与者可以通过这些活动深入了解机床行业,并与业内专家交流。

什么时候举办CME机床展?

CME机床展每年都会在中国举办,展会通常持续几天。具体日期和地点会在官方网站上公布,参展商和参观者可以提前了解,并做好相关的准备。

如何参展或参观CME机床展?

如果您是一家机床制造商或经销商,想要参展CME机床展,您可以在官方网站上找到相关信息,并按照指引进行注册和申请。如果您是一名机械工程师或对机床行业感兴趣的人士,您可以提前注册并获取参展门票。

感谢您的阅读

通过阅读本文,您了解了亚洲最大的机床展 - CME机床展的重要性和好处。参加CME机床展将使您能够了解最新的机床技术,建立业务联系,拓展市场,并参与专业论坛和研讨会。希望您能抓住这个机会,参加CME机床展,并从中获得丰富的收获。

三、cme机床展展会报告

CME机床展展会报告

本次CME机床展取得了圆满的成功,我们在此对所有参展商和观众表示衷心的感谢。作为业内知名的机床展览会,CME机床展一直以来都是业内人士关注的焦点,也是展示最新机床技术和产品的最佳平台。本次展会我们看到了许多令人印象深刻的机床技术和产品,同时也发现了一些值得关注的问题和趋势。

展会亮点

- 参展商数量众多:本次展会吸引了来自全球各地的众多参展商,他们带来了各种不同类型的机床技术和产品,为观众提供了丰富的选择。

- 新技术和新产品展示:许多参展商展示了他们的最新技术和产品,包括自动化机床、数控机床、3D打印机床等,这些技术和产品在精度、效率、智能化等方面都有显著的提升。

- 市场需求旺盛:观众数量众多,他们对机床技术和产品的需求非常旺盛,这也反映了机床行业的高成长性和广阔的市场前景。

问题和趋势

在本次展会上,我们也发现了一些问题和趋势。首先,一些传统的机床技术和产品仍然占据着市场的主导地位,但随着科技的进步和市场的变化,一些新的技术和产品正在逐渐崭露头角。其次,机床行业的竞争越来越激烈,如何提高产品质量、降低成本、提高效率成为企业必须面对的问题。最后,环保和可持续发展成为机床行业的重要议题,如何实现绿色制造和低碳生产也是企业必须考虑的问题。

结语

总的来说,本次CME机床展给我们带来了许多启示和思考。我们相信,在业内人士的共同努力下,机床行业将会不断发展和壮大。我们期待未来能够看到更多的新技术、新产品和更好的市场表现。

四、cimt展会

【博客文章】Cimt展会的独特魅力

亲爱的读者们,您们好!今天我们将一起探讨一个在工业领域中备受瞩目的盛会——Cimt展会。首先,让我们来了解一下这个展会的基本信息。 Cimt展会,全称是国际机械制造技术展览会,自1985年以来,每年在全球各大工业城市举办。这个展会旨在为全球机械制造领域的专业人士提供一个交流和学习的平台,促进机械制造技术的创新和发展。作为工业领域的盛会,Cimt展会吸引了来自世界各地的机械制造企业和研究机构参展,展示最新的机械制造技术和产品。同时,展会也邀请了众多行业专家和学者进行演讲和交流,分享最新的研究成果和行业动态。

在Cimt展会上,我们不仅可以了解到最新的机械制造技术和产品,还可以感受到这个展会所散发出的独特魅力。首先,Cimt展会注重实践和应用,参展的企业和机构都会带来实际的应用案例和解决方案,让参展者能够亲身感受到技术的实际效果和应用价值。其次,Cimt展会是一个开放的平台,参展者和观众可以自由交流和讨论,共同探讨机械制造领域的未来发展趋势。

对于机械制造企业来说,Cimt展会是一个展示实力、拓展市场的重要机会。通过参加展会,企业可以结识更多的业内人士,了解行业动态和市场需求,找到更多的合作伙伴和商业机会。同时,企业也可以将最新的技术和产品展示给客户和合作伙伴,提升品牌知名度和竞争力。

总之,Cimt展会是一个充满活力和机遇的工业盛会。如果您是机械制造领域的专业人士,一定不要错过这个展会。在这里,您将能够了解到最新的技术和产品,与业内人士交流和讨论,探索机械制造领域的未来发展趋势。

同时,如果您是一名机械制造领域的创业者或学生,Cimt展会也是一个学习和成长的好机会。在这里,您可以接触到行业的专家和学者,了解最新的研究成果和行业动态,为未来的发展打下坚实的基础。

最后,我们期待着您的参与,共同见证机械制造领域的繁荣和发展。

五、What is CME? Understanding the Full Form of CME in Finance

In the world of finance, CME is an acronym that stands for the Chicago Mercantile Exchange. It is one of the largest and most well-known financial derivatives exchanges in the world. But what exactly is the Chicago Mercantile Exchange and what does it do?

What is CME?

The Chicago Mercantile Exchange, commonly referred to as CME, is a global marketplace where various financial instruments, including futures and options contracts, are traded. It was established in 1898 and has since become a key player in the financial industry. CME operates as a self-regulatory organization, providing a platform for buyers and sellers to trade and manage their financial risks.

Full Form of CME

The acronym CME originally stood for "Chicago Mercantile Exchange," but over time, as the exchange expanded its offerings and global presence, the term CME has come to represent much more. Today, it not only refers to the physical exchange but also encompasses the CME Group, a leading financial company that includes various exchanges, clearinghouses, and data services.

Role of CME in Finance

CME plays a vital role in the finance industry by providing a platform for market participants to hedge against or speculate on price movements in various financial assets. Its primary products include futures and options contracts on interest rates, stock indexes, foreign currencies, agricultural commodities, energy, and metals. These derivative contracts allow market participants to manage risk and gain exposure to different asset classes.

Benefits of CME

The CME offers several advantages for market participants:

- Liquidity: The CME provides a highly liquid trading environment, with a large number of participants and significant trading volumes. This liquidity ensures that buyers and sellers can easily find counterparties for their trades.

- Price Discovery: Due to its broad participant base and active trading, the CME is an important venue for price discovery. Prices established on the CME are often used as references by market participants around the world.

- Risk Management: Market participants can use CME products to manage risks associated with price fluctuations in various asset classes. Hedging strategies using CME futures and options contracts allow businesses, investors, and speculators to protect themselves against adverse price movements.

- Global Reach: With its global footprint, the CME provides access to a wide range of international markets, allowing market participants to gain exposure to different regions and asset classes.

Conclusion

The Chicago Mercantile Exchange, or CME, is an essential financial institution that plays a crucial role in the global finance industry. It provides a platform for trading a wide range of financial instruments, allowing market participants to manage risk and gain exposure to different asset classes. Understanding the full form of CME and its significance in finance is essential for anyone involved in the financial markets.

Thank you for reading this article on the full form of CME in finance. We hope that it has provided you with a clear understanding of what CME is and its role in the financial industry.

六、cme 展会

CME展会

CME展会,作为全球知名的专业展会之一,一直以来都备受关注。该展会每年都会吸引来自世界各地的参展商和观众,为大家提供了一个交流、合作和展示的平台。在过去的几年里,CME展会已经成为了全球展览行业的一颗璀璨明珠。

作为参展商,您可以在这个平台上展示您的产品、技术和解决方案,与同行竞争者进行交流和合作,开拓新的市场和商机。同时,您也可以了解行业的发展趋势和市场需求,以便更好地调整您的战略和产品线。

作为观众,您可以在这个平台上了解最新的产品和技术进展,探索新的市场和商机。您还可以与同行竞争者进行交流和合作,建立长期合作关系,共同应对市场的挑战。此外,您还可以了解行业的发展趋势和市场需求,以便更好地规划您的业务和发展方向。

CME展会不仅是一个展示和交流的平台,更是一个促进全球经济发展的重要引擎。在这个平台上,我们可以看到全球展览行业的繁荣和发展,也可以看到各参展商和观众的智慧和努力。

总的来说,CME展会是一个非常有价值的展览平台,它为参展商和观众提供了一个相互交流、合作和展示的机会。如果您是一名展览行业从业者或是对此感兴趣的人士,那么您一定不能错过这个机会。

七、CME in finance: Understanding the meaning and importance of CME

Introduction to CME in Finance

In the financial industry, CME is an acronym frequently used, but what exactly does it stand for? CME stands for Chicago Mercantile Exchange, which is a global derivatives marketplace based in Chicago, Illinois. It is one of the largest and most diverse financial exchanges in the world. CME offers a wide range of products, including futures and options on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, and more.

What is the Chicago Mercantile Exchange?

The Chicago Mercantile Exchange, known as CME, is a financial exchange where various financial instruments, known as derivatives, are bought and sold. It provides a platform for buyers and sellers to trade these instruments, which include futures contracts and options. CME facilitates the trading of these contracts by providing a centralized marketplace, where participants can engage in transparent, electronic trading.

The Importance of CME

CME plays a crucial role in the global financial system. It provides market participants, such as individual traders, institutions, and corporations, with a reliable and efficient venue to manage and mitigate their financial risks. This is achieved through the use of derivative products, which allow market participants to hedge against price fluctuations, access new investment opportunities, and trade in a secure and regulated environment.

Benefits of Trading on CME

Trading on CME offers several advantages for market participants:

- Liquidity: CME provides deep liquidity due to its large and diverse membership base. This ensures that there are always buyers and sellers available for various financial instruments, enhancing the ease of execution and reducing trading costs.

- Transparency: CME operates with transparency, providing market participants with access to real-time market data, including prices, volumes, and order books. This allows traders to make informed decisions based on accurate and up-to-date information.

- Regulation: CME is a regulated exchange, subject to oversight by regulatory authorities. This regulatory framework ensures fair and orderly trading, protects market participants' interests, and promotes market integrity.

- Risk Management: CME offers a wide range of derivative products that enable market participants to effectively manage their financial risks. It allows hedging against adverse price movements, enables portfolio diversification, and provides tools for risk assessment and analysis.

Conclusion

In summary, CME stands for Chicago Mercantile Exchange, which is a prominent financial exchange offering a variety of derivative products. It plays a vital role in the global financial system by providing a secure and regulated marketplace for trading. Participating in CME offers numerous benefits, including liquidity, transparency, regulation, and risk management capabilities. Understanding and utilizing CME can empower market participants to make informed financial decisions and effectively manage their investments and risks.

Thank you for reading this article about CME in finance. We hope this has provided you with valuable insights into the meaning and importance of CME in the financial industry.

八、What is CME? Exploring the Full Form of CME in Finance

Introduction

CME, an acronym for Chicago Mercantile Exchange, is a well-known financial institution that plays a crucial role in global financial markets. In this article, we will delve deeper into the full form of CME and understand its significance in the finance industry.

What is CME?

The Chicago Mercantile Exchange (CME) is one of the largest and most influential futures and options exchanges in the world. It operates as a marketplace where various financial instruments, such as commodities, currencies, and derivatives, are traded.

The Full Form of CME

CME stands for Chicago Mercantile Exchange. Founded in 1898, the exchange has grown to become a global leader in the derivatives market. Its mission is to enable individuals and organizations to manage risk and achieve their financial goals through efficient and transparent markets.

Role of CME in the Finance Industry

As an exchange, CME facilitates the trading of a wide range of financial instruments, providing market participants with a platform to buy and sell these assets. Its products include futures contracts, options, and forward contracts, which allow investors and businesses to hedge against price volatility or speculate on future price movements.

The CME is particularly renowned for its role in commodities trading. It offers contracts for various commodities, including agricultural products, energy resources, precious metals, and livestock. These contracts provide market participants with a way to manage their exposure to price fluctuations in these commodities, ensuring stability and risk mitigation in the global commodity markets.

Benefits of Trading on CME

Trading on the CME offers several benefits to market participants:

- Liquidity: The CME's trading volumes are among the highest in the world, ensuring ample liquidity for traders.

- Price Transparency: CME's electronic trading platform provides real-time price information, ensuring transparency and fair pricing.

- Central Counterparty Clearing: CME acts as the central counterparty, reducing counterparty risk and ensuring the integrity of transactions.

- Global Reach: CME provides access to global markets, allowing market participants to trade in different time zones and access a diverse range of products.

Conclusion

CME, the Chicago Mercantile Exchange, is a leading financial institution that facilitates the trading of various financial instruments, including commodities, currencies, and derivatives. Its role in the finance industry is vital, offering market participants a platform to manage risk, hedge against price fluctuations, and speculate on future price movements. Understanding the full form of CME and its significance is essential for anyone seeking to navigate the global financial markets successfully.

Thank you for reading this article and gaining insights into the full form of CME in finance. We hope this information has been helpful in expanding your knowledge of the finance industry.

九、cme检测法?

CME检测法是基于融合特征和时空连续性判定规则的方法,可检验土壤中铅含量。

十、cme夹具有哪些?

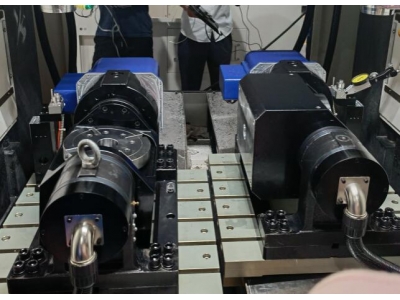

1.五轴多主轴双工位倾斜转台,适用于加工转向节,左右对称工件,相同零件。高速、高精度的分割系统,结构紧凑;内置多路油压旋转接头,标准化的夹具接口;刚性高,夹紧力强大。

2.精密弹性夹头卡盘,弹性夹套相比金属夹头寿命更长,不同夹套配合卡盘可以实现快换,实例案例中用于减震杆、蜗轮轴等工件加工。

发布于

2024-04-29

发布于

2024-04-29